How to Use ROI Calculators for Lighting Budget Planning

Learn how ROI calculators can help you effectively plan your lighting budget by assessing energy savings and maintenance costs.

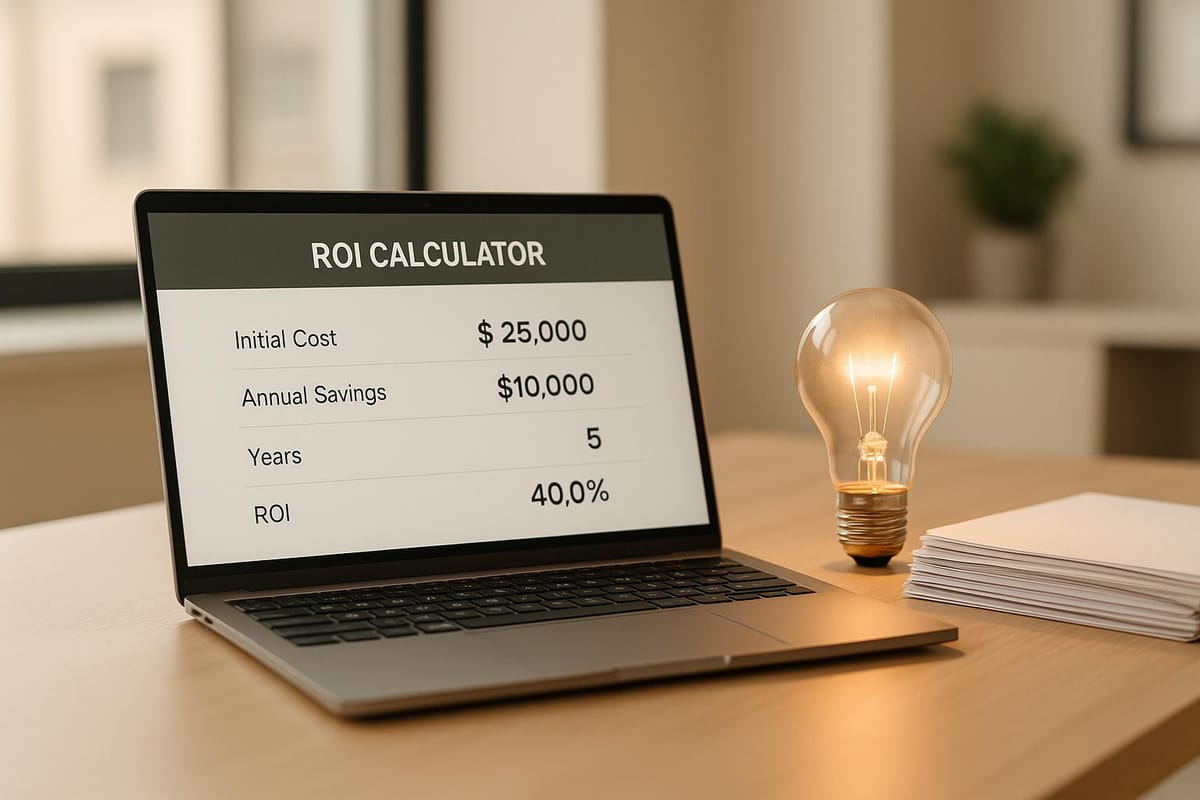

Want to plan your lighting upgrade with confidence? ROI calculators simplify the process by showing you the financial benefits of switching to energy-efficient lighting. From energy savings to reduced maintenance costs, these tools help you assess whether the investment is worth it.

Here’s what you need to know:

- ROI calculators compare current lighting costs with potential savings from LED upgrades.

- They factor in energy use, maintenance, utility rates, and incentives like rebates and tax deductions.

- Results include metrics like payback period, ROI percentage, and long-term savings.

How to Accurately Calculate LED Lighting Retrofit Savings

Required Data for Accurate ROI Calculations

The accuracy of your ROI calculations hinges on the quality of the data you gather. Solid, reliable input ensures your financial projections for lighting retrofit projects are as precise as possible.

Project Data You Need

Start by compiling a detailed inventory of your current lighting setup. This should include the number of fixtures, their types, wattage, and operating hours. For example, an office might only run lights during standard business hours, while a warehouse could require 24/7 operation. Using actual usage patterns - rather than assumptions - can greatly impact your payback period calculations.

Factor in all components of your local electricity rate, including demand charges and time-of-use fees. These details are essential for calculating energy savings accurately.

Don’t forget maintenance costs. Include recurring expenses like lamp and component replacements, along with labor costs. These figures complete the financial picture and help present a clear before-and-after comparison.

When planning your LED upgrade, document the details of the proposed fixtures. Capture key specifications such as wattage, lumens, and color temperature. Comparing the wattage of your current fixtures with the new LED options allows you to estimate energy savings while ensuring the new system delivers the same - or better - illumination.

Finally, consider any rebates and tax incentives available to refine your ROI estimates further.

Adding Rebates and Tax Incentives

Utility rebates can make a big difference by reducing initial project costs. Research local commercial lighting rebate programs, as some offer fixed incentives per fixture or base them on wattage savings. These rebates can significantly improve your project’s financial outlook.

Tax incentives, along with state or local programs, can also help offset costs. When evaluating your project, include all potential rebates, tax credits, and grants to get a complete picture of the total investment and potential ROI.

Getting Accurate Data from Energy Audits

Once you’ve gathered internal data and identified incentives, confirm your assumptions with an independent energy audit. Professional energy audits provide precise measurements, eliminating the guesswork. Rather than relying on estimates, auditors use tools like light meters and occupancy sensors to measure actual usage and light levels. They also determine the specific LED requirements to maintain or improve illumination quality.

Energy auditors often uncover opportunities that might go unnoticed, such as fixtures running unnecessarily or areas with excessive lighting. They ensure all available rebates and tax incentives are factored into your calculations. It’s worth seeking energy audit services that explicitly include these incentives in their reports, ensuring you maximize your financial benefits. Additionally, professional auditors are typically up to date on utility programs and can guide you through the often-complex incentive application process.

For example, Luminate Lighting Group offers comprehensive energy audits that provide the detailed data you need for accurate ROI calculations. Their audits document existing conditions, measure light levels, analyze usage patterns, and identify all applicable rebates and incentives. This thorough approach ensures your ROI calculations are based on real-world conditions, not estimates - leading to more reliable budget planning and smarter project prioritization.

Energy audits can also flag any code compliance issues that might affect your retrofit timeline or costs. Addressing these issues upfront prevents unexpected expenses and ensures your ROI analysis includes all necessary upgrades. This proactive approach can save both time and money in the long run.

How to Use ROI Calculators Step by Step

Once you've gathered all your project data, using an ROI calculator becomes a simple process. The trick is to enter the details carefully and interpret the results to make smart budgeting decisions.

Entering Your Project Data

Start by inputting your current inventory into the calculator. Be precise about the number and type of fixtures you have - like 150 fluorescent T8 fixtures at 32 watts each or 75 metal halide high bay lights at 400 watts. Even small differences in wattage can significantly affect the results, so accuracy is key.

Next, include your operating schedule. For example, an office might have lights on 10 hours a day, 5 days a week, while a warehouse could run 24/7. Enter the actual hours rather than guessing - this detail alone can shift your payback period by months or even years.

Don't forget to enter your electricity rates in full. This means including both the energy cost (e.g., $0.12 per kWh) and any demand charges (e.g., $15.00 per kW). Demand charges can account for 30-40% of a business's electricity costs, so leaving them out could skew your results.

Factor in maintenance costs for your existing setup. For instance, fluorescent lamps often need replacing every 2-3 years at $8-12 per lamp, plus labor. Ballast replacements, which cost $25-50 each, often require an electrician, adding to the expense.

When adding proposed LED specifications, use the manufacturer's data sheets to ensure accuracy. For example, a 32-watt fluorescent might be replaced by a 15-watt LED with equal or better light output. Include details like wattage, lumens, and lifespan - quality LEDs often last 50,000 hours or more.

Once all your data is entered, you're ready to explore different scenarios.

Testing Different Scenarios

With your data in place, you can experiment with various factors to see how they affect your financial outcomes. Here are some ideas:

- Adjust electricity rates to account for potential increases. For example, if your current rate is $0.12 per kWh, test scenarios at $0.14 or $0.16 to understand how rising rates impact your ROI.

- Compare different LED options. Premium LEDs might cost 20-30% more upfront, but they often come with better warranties, higher efficiency, and longer lifespans. Testing both budget and premium options can help you decide if the extra cost is worth it.

- Evaluate rebate opportunities. If your utility offers $25 per fixture for standard LEDs and $40 for premium models, compare both scenarios. Sometimes, higher rebates make premium options more appealing.

- Modify operating schedules to reflect potential changes. For example, if a retail store plans to extend its hours, you can see how this increases the savings from LEDs. Conversely, reduced hours might lower your ROI projections.

Reading Your Results

After testing scenarios, it's time to analyze the results. Here's what to focus on:

- The payback period shows how long it takes to recover your initial investment through energy savings. For example, a payback period of 2.5 years means you'll break even after 30 months. Lighting projects with payback periods under 3 years are often considered a great investment.

- The ROI percentage indicates your annual return on investment. For instance, an ROI of 35% means you're earning 35 cents for every dollar invested each year - far better than many traditional investments.

- Net present value (NPV) accounts for the time value of money over the project's lifespan. A positive NPV means the project will generate more value than it costs, even when factoring in inflation and opportunity costs. The higher the NPV, the stronger the long-term benefits.

- Look at cumulative savings over 10-15 years. While the payback period might be just a couple of years, total savings over the lifespan of an LED system can reach $150,000 or more for larger facilities. This long-term perspective often solidifies the case for investing in LEDs.

- Review cash flow projections to see how the investment impacts your finances month by month. Many calculators provide detailed breakdowns, showing when you'll transition from initial costs to positive cash flow. This is especially helpful for planning budgets.

Using ROI Results for Budget Planning

With your ROI calculations in hand, you can make smarter budget decisions to get the most out of your lighting investments.

Ranking Projects by ROI

Focus on key metrics like payback period and ROI percentage to decide which lighting projects to tackle first, while keeping cash flow in mind. Sometimes, smaller upgrades with quicker paybacks are easier to manage and can collectively deliver more savings than a single, larger project.

That said, don’t dismiss projects with longer payback periods if they offer strong long-term benefits. For example, a comprehensive facility-wide upgrade might take more time to recover costs but could lead to significant savings over its lifespan. When ranking projects, think beyond just the financial returns - factor in operational improvements as well. These rankings will help you strategically include lighting upgrades in your overall capital plan.

Adding ROI to Your Capital Planning

Use your ROI projections to align lighting upgrades with your broader capital planning efforts. This means coordinating upgrades with scheduled facility improvements and factoring in financing options. The goal? Balance short-term costs with long-term savings.

Consider allocating a portion of your maintenance budget to lighting upgrades to generate early positive cash flow. Timing is also key - plan projects to take advantage of rebates and optimize cash flow. And don’t forget to include contingency plans. Energy costs can fluctuate, so having multiple ROI scenarios based on potential electricity rate changes will allow you to adjust priorities as market conditions shift.

Comparing Different Lighting Options

ROI calculations shine when you’re deciding between various lighting solutions for the same space. Create a comparison framework that looks beyond upfront costs to evaluate the full financial picture over time.

For instance, when comparing LED options, one model might offer a faster payback period, while a premium option could provide greater energy savings annually. Even if the premium model takes longer to pay off, its long-term savings might make it the better investment.

To make informed decisions, compare upfront costs, maintenance expenses, and potential rebate impacts. You can even use a table to clearly show payback periods and long-term savings. Don’t forget scalability - features like automated dimming and scheduling from a lighting control system might add to the initial cost but could lead to additional energy savings down the line. Make sure your ROI calculations factor in these added benefits.

Getting Better ROI with Professional Help

Accurate data is essential for calculating ROI, but teaming up with lighting professionals can take your results to the next level. While ROI calculators provide a solid starting point, experts refine your data and uncover additional opportunities to maximize returns.

Benefits of Professional Energy Audits

A professional energy audit lays the groundwork for precise ROI calculations by identifying inefficiencies that might otherwise go unnoticed. For instance, Luminate Lighting Group offers detailed lighting audits that provide the critical data needed for accurate ROI evaluations.

These audits go beyond surface-level analysis. They include photometric layouts and pinpoint hidden energy waste, such as over-lit areas or fixtures running longer than necessary. These insights directly influence ROI by addressing inefficiencies that could be draining resources.

Another key advantage is uncovering potential maintenance savings. Professionals assess your current lighting setup and identify costs related to bulb replacements, ballast repairs, and labor. Factoring these expenses into your ROI calculations ensures a more comprehensive financial picture.

Energy audits also consider your facility's unique operational needs. For example, motion sensors might be ideal for a warehouse's low-traffic zones, while offices could see better returns with daylight harvesting controls. Tailored recommendations like these ensure your ROI reflects how your facility actually operates.

Getting Help with Rebates and Incentives

Rebates and tax incentives can significantly improve your project's ROI, but navigating their complexities can be challenging. Professional lighting providers like Luminate Lighting Group specialize in identifying and securing these financial benefits, helping reduce overall project costs.

Utility rebates vary by location and provider, each with its own specific requirements for fixture types, installation methods, and documentation. Experts handle these applications efficiently, ensuring you don't miss out on available savings.

One major opportunity is the 179D tax deduction, which offers substantial benefits for qualifying commercial lighting upgrades. However, the qualifications can be intricate, making professional guidance invaluable.

Experts also know how to combine multiple incentives effectively. By leveraging a mix of utility rebates, tax deductions, and local programs, they can help you enhance the financial viability of your lighting retrofit project.

Meeting Code Requirements and Long-Term Savings

Energy codes are becoming stricter, and failing to comply can lead to costly retrofits down the line. Professional lighting providers design upgrades that not only meet current codes but also anticipate future changes, safeguarding your investment.

While systems that just meet minimum standards might save money upfront, they often require expensive updates as codes evolve. Professionals focus on exceeding these standards, ensuring your lighting system remains compliant and cost-effective over time.

Smart lighting controls are another area where expert input can make a big difference. Although these systems may increase initial costs, they often deliver energy savings beyond what LED fixtures alone can achieve. Professionals can recommend the most effective control strategies tailored to your facility's needs.

Luminate Lighting Group also provides ongoing support to ensure your lighting system continues to perform as expected. From troubleshooting to adjusting controls as your facility's needs change, they help maximize your long-term savings.

Additionally, professional installation protects your warranty and ensures your system operates at peak performance from day one. When experts oversee the project from design to installation, you can trust that your ROI calculations accurately reflect the benefits of your lighting upgrade.

Conclusion

ROI calculators take the guesswork out of budgeting by turning raw data into actionable insights. When you pair accurate project details with realistic estimates for energy costs and maintenance savings, these tools provide the financial clarity you need to make a strong case for lighting retrofits.

But remember, the quality of your results depends entirely on the quality of your inputs. Factors like current energy usage, fixture specifications, operating hours, and local utility rates all play a critical role in shaping your calculations. Even small errors in these inputs can lead to misleading savings projections.

Running different scenarios through the calculator can help you fine-tune your lighting strategy. This approach not only identifies the setup with the best financial outcome for your facility but also prepares you for budget discussions. By showcasing various investment levels and their potential benefits, you'll be better equipped to make informed decisions.

Key Points Summary

Expert guidance can take your ROI calculations to the next level, ensuring accuracy and helping you tap into all available incentives. Luminate Lighting Group specializes in combining detailed energy audits with knowledge of utility rebates and tax benefits, such as the 179D deduction, to help clients achieve realistic ROI projections that align with actual performance.

While ROI calculators are a great starting point for ranking projects and planning budgets, the most successful lighting retrofits go beyond the numbers. They integrate the calculator's insights with professional expertise to address code requirements, fine-tune system designs, and maximize financial returns.

FAQs

What mistakes should I avoid when using an ROI calculator for lighting projects?

Tips for Accurate ROI Calculations in Lighting Projects

When using an ROI calculator for your lighting projects, it's easy to make small mistakes that can throw off your results. Here are a few things to watch out for:

- Overestimating costs or underestimating savings: If you inflate costs or downplay potential savings, your ROI projections might not reflect reality. Stay as precise as possible.

- Leaving out important details: Forgetting to include data like energy rates, maintenance expenses, or available utility rebates can skew your calculations significantly.

- Entering incorrect units or formats: Make sure you're using the right measurements - such as wattage or energy usage - in the format specified by the calculator.

Take the time to double-check your inputs and carefully follow the calculator's guidelines. This way, you’ll get insights you can trust for planning your lighting budget effectively.

How can I make sure rebates and tax incentives improve my ROI for a lighting project?

Making the Most of Rebates and Tax Incentives

To get the best return on investment (ROI) from rebates and tax incentives, start by researching all the programs available in your area and for your specific project. These could include utility rebates, federal tax credits, or incentives offered at the state level. Once identified, factor these savings into your ROI calculations by deducting them from your initial project costs and including any related tax benefits. This step can make a noticeable difference in your overall financial returns.

It's crucial to keep your documentation in order and ensure that all incentives are approved before wrapping up your project. Doing so helps you avoid unexpected delays or missing out on valuable savings. With careful planning and a focus on eligibility, you can maximize the financial rewards of your lighting upgrade.

Why should I choose a professional energy audit instead of using my own data for ROI calculations?

Professional energy audits deliver clear and in-depth insights into how your energy is being used, pinpointing inefficiencies and providing tailored suggestions for improvement. This means your ROI calculations for lighting upgrades are grounded in accurate, reliable data instead of rough estimates.

These audits also often reveal unexpected opportunities to save in areas like HVAC systems or insulation - details that might be missed if you're relying on self-gathered information. By taking this comprehensive approach, you can make smarter decisions, reduce energy waste, and get more value out of your investments.